Calculate my roth ira

If however you withdraw earnings early from a Roth IRA you may owe income tax and a 10 penalty. The participant died or.

Roth Ira Calculators

A Roth IRA conversion is a way to move money from a traditional SEP or SIMPLE IRA or a defined-contribution plan like a 401k into a Roth IRA.

. 1 With Fidelity you have a broad range of investment options including. Roth IRAs are a type of tax-advantaged individual retirement account that should be invested in with a long-term perspective in mind. Best alternatives to a 401k Best Roth IRA accounts.

It is used for a distribution from a Roth IRA if the IRA custodian does not know if the 5-year holding period has been met but. What is a spousal IRA. Roth TSPs are the US.

Contributions are made with after-tax money and any potential earnings grow tax-free. If you had a transfer or rollover to your Schwab retirement accounts a conversion from a traditional IRA to a Roth IRA and back or any correction for security price after year-end please call us at 877-298-8010 so we can recalculate your RMD. The participant has reached age 59.

A custodial IRA allows the account holder in this case your child to contribute after-tax dollars toward retirement. The participant is disabled. You dont have to take RMDs from a Roth IRA if youre the original account owner.

To do so please call one of our IRA Specialists at 1-866-226-5638. A Roth IRA is a retirement savings account that allows individuals to withdraw amounts tax-free. Qualified distributions which are tax-free and not included in gross income can be taken when your account has been open for more than five years and you are at least age 59½ or as a result of your death disability or using the first-time homebuyer exception.

More Understanding the 5-Year Rule. How to calculate your SEP IRA contribution If you pay yourself a salary using a IRS W-2 form then calculating your maximum allowed SEP IRA contribution is easy. To calculate the penalty on an early withdrawal.

Additionally youre able to withdraw your contributions tax-free and penalty-free at any time for any reason. And the penalties and taxes you have to pay on that money depend on the type of retirement account it came from. Additionally you dont have to pay taxes when you make qualified withdrawals.

So you wont report them on your. What is a spousal IRA. Best places to roll over your 401k Best retirement plans for self-employed.

A Roth IRA is an individual retirement account that you open and fund directly. This interview will help you determine if your distribution from a Roth IRA or designated Roth account is taxable. However if you have inherited a Roth IRA you are subject to RMD rules.

A good foundation for a Roth IRA portfolio is a combination of. Best places to roll over your 401k Best retirement plans for self-employed. Roth IRA Traditional IRA.

A Roth IRA can be a powerful way to save for retirement since potential earnings grow tax-free. A code T in box 7 of 1099-R is for a Roth IRA distribution when an exception applies. Once youve opened your Synchrony IRA you can complete additional transfers using our Transfer Request form or Direct Rollover Request form available online in our Help tools section at the bottom of the page under Bank Forms.

Best alternatives to a 401k Best Roth IRA accounts. Governments version of a Roth 401k and theyre funded through payroll deductions. There are ordering rules when taking nonqualified.

You always have the option to convert your Traditional IRA into a Roth IRA. As soon as those 60 days are up the money from the IRA is considered to be cashed out. A Roth IRA offers many benefits to retirement savers.

For 2022 total 401k contributions pre-tax after-tax employer matching contributions and any other non-elective. Roth IRA Withdrawal Rules. Your Age 5-Year Rule Met Taxes and Penalties on Withdrawals Qualified Exceptions.

Roth contributions arent tax-deductible and qualified distributions arent taxable income. Roth IRAs have two types of distributions. Heres how to calculate your mega backdoor Roth IRA contribution limit.

401k Withdrawing money from a 401k early comes with a 10 penalty. Roth IRA accounts are funded with after-tax dollarsmeaning you will pay taxes on it when you deposit the funds. 401k traditional IRA or Roth IRA.

Traditional IRA Withdrawal Penalties. This topic doesnt address either the return of a Roth IRA contribution or return of a prior years excess contribution or a corrective distribution of excess contribution from a designated Roth account. The Roth IRA allows workers to contribute to a tax-advantaged account let the money grow tax-free and never pay taxes again on withdrawals.

For the most part a custodial Roth IRA operates in the same way as a. She could wait until she turns 72 to begin taking RMDs. Sometimes FMV and RMD calculations need to be adjusted after December 31.

You can find an IRA withdrawal penalty calculator or simply multiple the taxable amount by 010 to calculate the penalty. Best IRA accounts. For tax-deferred retirement accounts withdrawing from a Roth IRA will not meet the RMD requirement.

Note that if you take a nonqualified withdrawal from your IRA you must pay an additional 10 percent as a penalty on the taxable portion of the withdrawal unless you fall under an exception. For example assume Wilma age 69 inherits a Roth IRA from her late husband Fred age 73 and puts the money in an inherited IRA account.

Roth Ira Calculators

Download Roth Ira Calculator Excel Template Exceldatapro

Roth Ira Conversion Calculator Excel

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

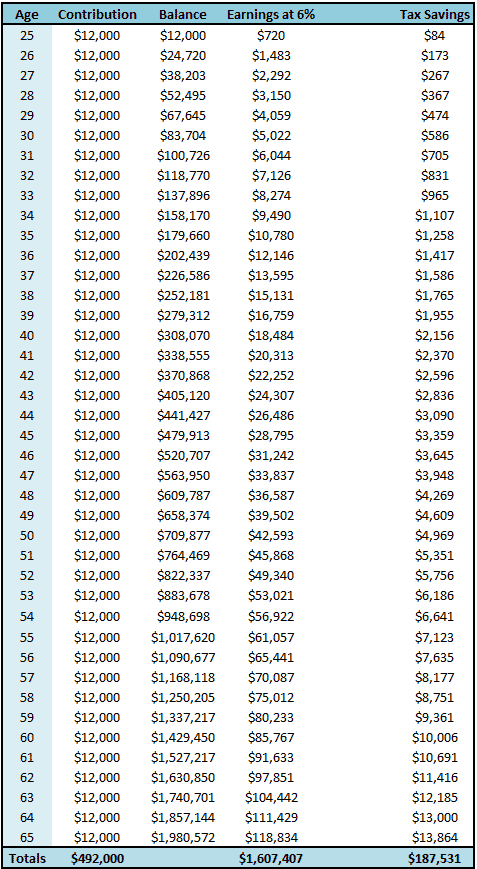

Roth Ira Calculator Roth Ira Contribution

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Traditional Vs Roth Ira Calculator

Optimize Your Retirement With This Roth Vs Traditional 401k Calculator

Ira Calculator Roth Cheap Sale 53 Off Www Wtashows Com

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Calculating The Value Of Your Backdoor Roth Contributions Physician On Fire

Traditional Vs Roth Ira Calculator

Ira Calculator See What You Ll Have Saved Dqydj

What Is The Best Roth Ira Calculator District Capital Management

What Is The Best Roth Ira Calculator District Capital Management