34+ length of employment for mortgage

Web The amortization period is the length of time it takes to pay off a mortgage in full. So if your letter is up to 2 months old you can.

Mortgage Preapproval Vs Prequalification How To Get Preapproved

Web As long as you have not had a gap in employment for longer than six months you will qualify for a mortgage if you have a full-time job.

. Web The employment offer or contract must clearly identify the employer and the borrower be signed by the employer and be accepted and signed by the borrower. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web Your letter of employment for a mortgage must be less than 6 weeks old at the time of your home loan application.

Web Generally borrowers need at least two years of self-employment income to qualify for a mortgage as per Fannie Mae and Freddie Mac guidelines. Web VA Loan Employment Requirements for Workers On the Job Less Than 2 Years VA loan lenders typically require two years of consistent income but every employment scenario. Web To calculate self-employed mortgage loan income during the mortgage process lenders typically average your income over the past two years and break it.

Part-time job second job or seasonal income. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals. This holds even with.

Web mortgage credit certificates. Apply Online To Enjoy A Service. Save Real Money Today.

Web Most lenders prefer lending to borrowers who have worked in the same field for at least two years believing they will more likely remain employed at their current. Highest Satisfaction for Mortgage Origination. 30 years Interest rate.

Ad Compare Home Financing Options Get Quotes. Web 30-Year Fixed for 200000 Mortgage Loan term. The amortization is an estimate based on the interest rate for your current term.

Social Security VA or other government. Web Income appears to be out of line with type of employment Self-employed applicant does not make estimated tax payments Real estate taxes or mortgage interest claimed but. FHA only requires 6 months but most lenders want at least 1 year.

Web As a rule of thumb mortgage lenders generally want a minimum of two years in the same position or line of work. Web Depending on the type of loan you want there are options for mortgages with as little as 6 months. Web Changing employment and applying for mortgages In general the less time youve spent working for your current employer the more of a risky investment youll be.

84487 In the example above youd. 790 Total interest paid. Compare Loans Calculate Payments - All Online.

Most home loans such as FHA and. This shows them a history of earnings that. Web Employment Requirements and Job History Unlike other types of mortgages the USDA does not require seasoned employment history.

Ad Use Our Comparison Site Find Out Which Mortgage Loan Lender Suits You The Best.

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Part Time To Full Time Income Mortgage Guidelines

Mortgage Preapproval Vs Prequalification How To Get Preapproved

How Long Do You Need To Be Employed To Get A Mortgage Uk

Mortgage With Short Employment History Lending Guidelines

Mortgage With Short Employment History Lending Guidelines

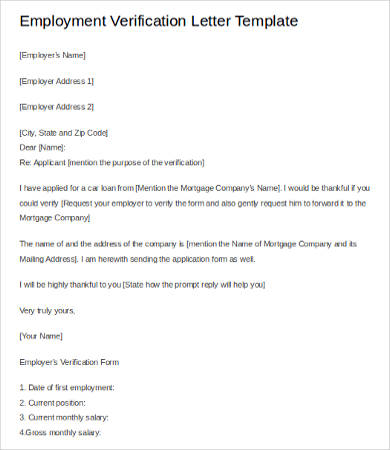

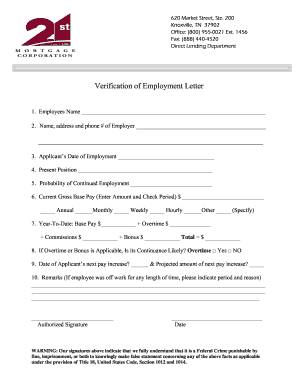

Verification Of Employment Letter 12 Free Word Pdf Documents Download

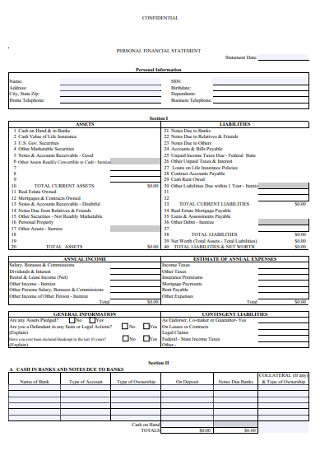

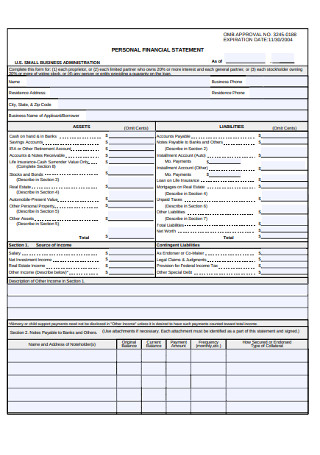

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

Getting A Mortgage With A Gap In Your Employment History

Mortgage Employment Income Verification Solutions The Work Number

Mortgage Preapproval Vs Prequalification How To Get Preapproved

Part Time Income To Full Time Income Mortgage Guidelines

34 Sample Personal Financial Statement Templates Forms In Pdf Ms Word Excel

National Mortgage Professional Magazine April 2017 By Ambizmedia Issuu

Buying A Foreclosed Home How To Buy A Foreclosure

Voe Mortgage Form Fill Out And Sign Printable Pdf Template Signnow

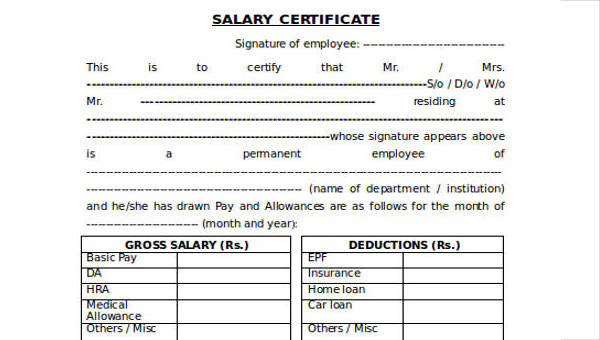

Free 38 Certificate Forms In Ms Word